Historical Trends in Gold & Silver

About Gold

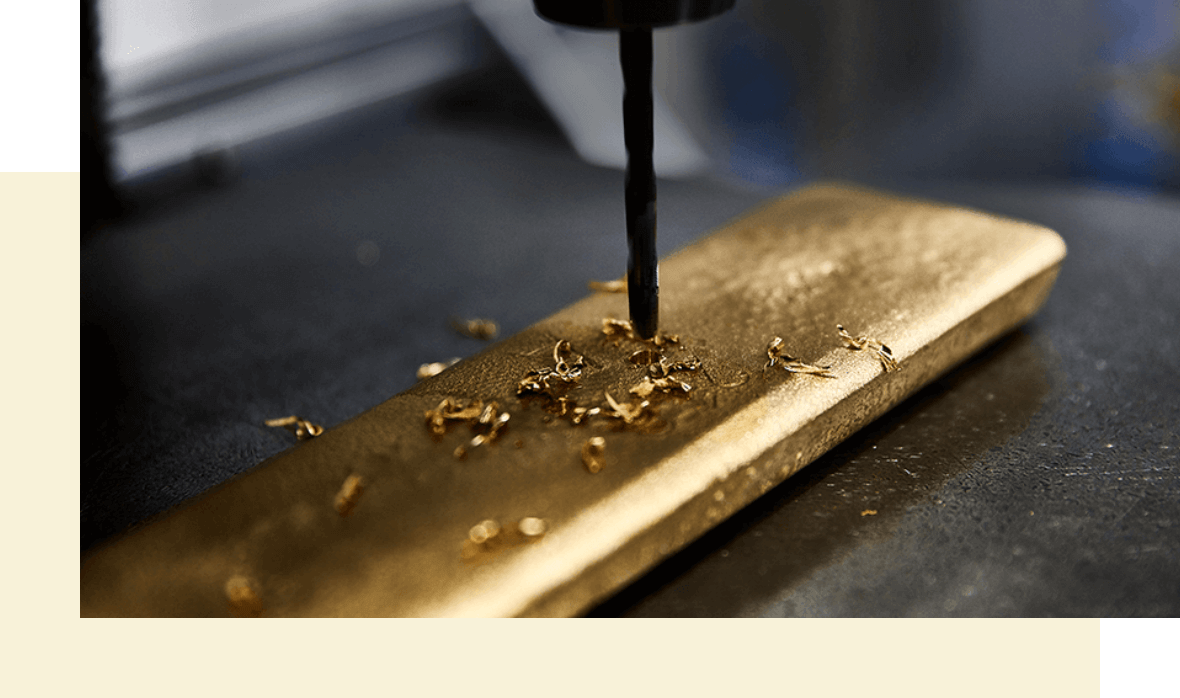

Possessing physical gold is a primary objective today, offering assistance in navigating complex portfolios. Gold provides protection against the impact of currency devaluation, for instance, when governments intervene to adjust currency flexibility due to import-export trade.However, unlike being tied to any specific currency or nation, the value of gold is built upon the global supply and demand framework. Rising gold prices often act as an "anti-theft alarm”, warning us that inflation is eroding our bank accounts, and the purchasing power of our currency is gradually diminishing.

Gold is an everlasting source of value, offering those with foresight a secure passage through the most uncertain and turbulent times in the history. Possessing physical gold in your investment portfolios ensures resilience against the repercussions of devastating economic events, including stock market crashes and inflation. For some of us, incorporating physical gold to diversify asset allocation has become common sense in response to the prevailing uncertainty in today's world.

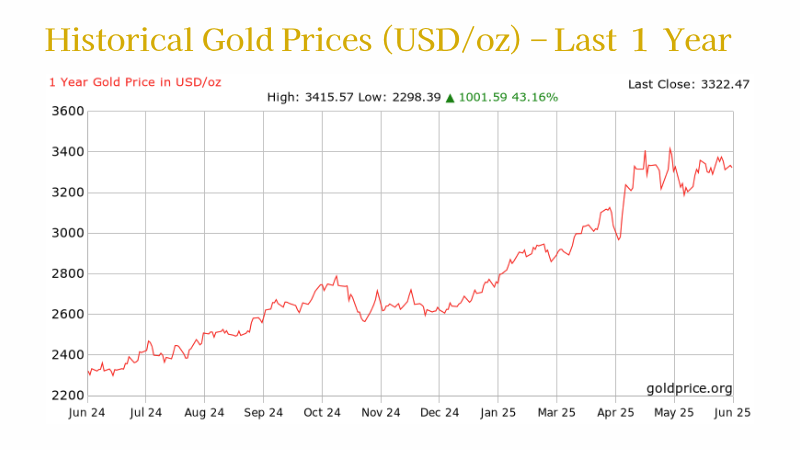

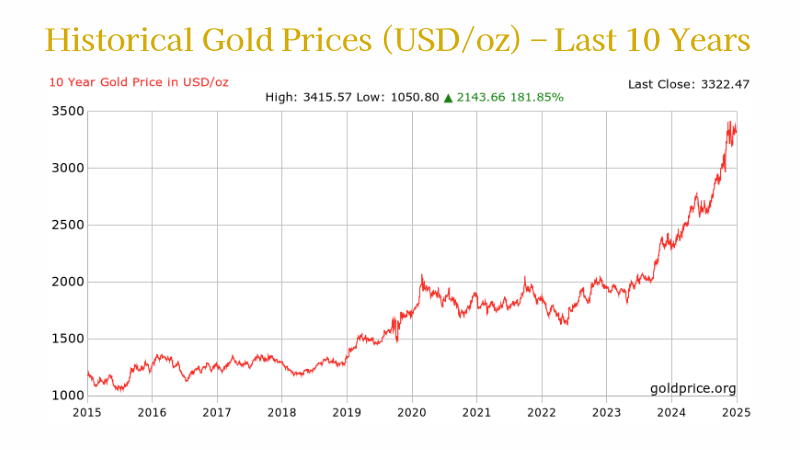

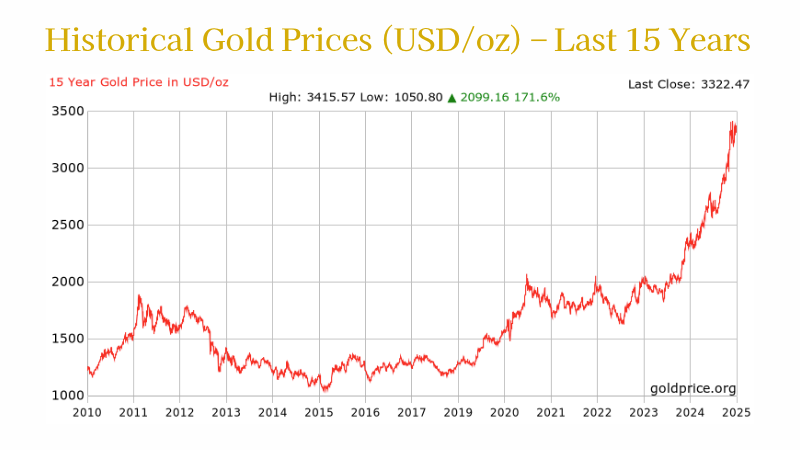

In the past decade, stats show that gold has outperformed the Dow Jones Industrial Average, the S&P 500 Index, and the Nasdaq Index, leading Mark Bristow, the Chief Executive of Barrick Gold Corp., to dub this period "a decade of free money”. Gold is viewed as a robust and stable strategy sought by everyone to safeguard the advantages of their long-term savings.

In the past decade, stats show that gold has outperformed the Dow Jones Industrial Average, the S&P 500 Index, and the Nasdaq Index, leading Mark Bristow, the Chief Executive of Barrick Gold Corp., to dub this period "a decade of free money”. Gold is viewed as a robust and stable strategy sought by everyone to safeguard the advantages of their long-term savings.

The History of Gold

Since the early days of human civilization, gold has played the ultimate symbol of beauty, wealth, immortality, and power across various cultures throughout the world, and even before its use as currency, gold held significant importance. Rulers and elites considered it an object of worship, creating temples, figurines, various vessels, and jewelry. Today, much like in ancient times, the inherent value of gold holds the same universal allure. Its beauty, rarity, uniqueness, and malleability, allowing it to take any form for preservation, naturally position gold as a timeless medium of exchange.

Gold Represents the Very Concept of Currency:

Portable

Permanently Preservable

Shortly after being minted into standardized coins, gold and silver replaced the barter system. Dating back to 560 BCE, gold was already recognized and utilized as a form of currency.

On April 5 1933, President Franklin D. Roosevelt issued Executive Order 6102, forbidding the hoarding of gold and restricting individuals from owning more than 5 ounces. Those holding huge amounts of gold were compelled to sell it to the government at a rate of $20.67 per ounce.

Soon after this compulsory sale, the international price of gold, as set by the US Department of the Treasury, increased to $35 per ounce. This resulted in a 41% devaluation of the U.S. dollar. (which had just been enforced upon citizens in exchange for their gold)

It is estimated that only 1% of the coins existing at that time survived after widespread melting. The government maintained the price of gold at $35 per ounce until August 15, 1971, when President Richard Nixon announced the end of the gold standard, discontinuing the fixed convertibility of the U.S. dollar into a specific amount of gold.